The S&P 500 is back almost 50% from its March lows and now ready to make new records. Money in circulation is up almost 30% year over year (source: St. Louis Fed), while the economy remains mired and vulnerable; the unemployment rate remains at multi-decade highs, and to quote Chairman Powell (June 10 speech), the Fed is not even “thinking about thinking about raising rates”. Could the stock market, especially the tech sector, go any higher if the economy does not recover?

The short answer is yes, it can, because if history is any guide, stock buybacks, especially in the tech sector, are likely going to make a comeback, just as they did after the global financial crisis. This, of course, excludes companies that borrowed money from the Federal government as part of the CARES Act and are prohibited from stock buybacks for a year after the money has been repaid. But buyback-happy companies swimming in cash such as AppleAAPL and Warren Buffett’s Berkshire HathawayBRK.B to name a few aren’t looking for government bailouts.

The combination of cheap money and a weak economy together could imply that US corporations can justify buying back more of their stock rather than spending it on stuff for which there might be no demand. This is nothing new, and despite attempts by some politicians to make buybacks illegal, there is really nothing stopping companies from doing what they need to do to get their valuations up. Recall that until the recent crisis which made the Fed the lender of last resort and buyer of corporate securities, bidding up stock prices in the process, buybacks were the main forces behind rising stock prices. The handoff from the Fed back to the corporate sector will put another floor below stock prices.

Corporate cash levels are at extremely high levels, and corporate funding costs are at rock-bottom levels. With the enormous amount of liquidity and credit that has been pumped into the system by the Fed, corporations have borrowed money like there is no tomorrow. For example, information technology companies have increased their borrowing by almost 200% year over year in the first six months, and simultaneously taken the opportunity to extend out the debt to longer maturities, thus locking in cheap funding costs (Source: Morgan Stanley Corporate Credit Research).

After the shock of March of this year, even MicrosoftMSFT and GoogleGOOGGOOGL have benefited from the Fed, and taken the opportunity to issue massive amounts of new debt. Google announced a buyback and $10 billion of new borrowing (including $2 billion of a 40-year maturity bond at a yield of just over 2%) this week which was massively oversubscribed (Bloomberg, Aug. 3, 2020). According to Bloomberg, Apple has $194 billion of cash, Microsoft $137 billion, Alphabet $121 billion, and AmazonAMZN $71 billion. That’s a whole lot of ammunition to buy back stock with money lent by willing lenders.

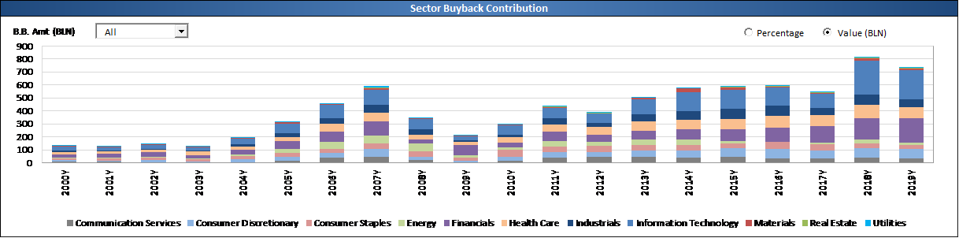

Just as buybacks peaked before the Great Financial Crisis of 2008 and then started up in force after the Fed’s liquidity injections, we are possibly looking at a resumption of record buybacks on the back of the massive monetary injection.

VINEED BHANSALI, BASED ON BLOOMBERG DATA.

And don’t forget the Fed is actually lending these mega companies even more money as part of its various debt facilities, and these companies are actually borrowing beyond that with global yields so low. Their coffers are literally overflowing with money!

Amongst the main lenders who are buying the corporate issuance remain foreign investors and insurance companies. Foreign investors are attracted to the still positive yield of US corporate debt which must look juicy compared to negligible yield in their own countries. For insurance companies, yield is necessary for the insurance model to work. The US stock market is thus the main beneficiary of both global cheap money policies and the need for yield. One might be worried that corporate leverage is again reaching stratospheric levels. In the investment grade arena gross leverage is 2.7x, as compared to 2.3x after the dotcom crash, and 2.1x after the financial crisis (Source: Morgan Stanley Credit Research, Aug. 3, 2020). But with all this cash pouring in, the real risk today is that the liquidity spigots are somehow turned off. I don’t see any signs of this from the Fed, yet. If anything, they are likely to step up the supply of money to another new level.

Are we in in the starting gates of another decade long bull market in stocks even as the economy struggles? If the post GFC bull market was the most hated bull market of all time, this one would probably be the most surprising one of all time. But all this money has to go somewhere, and stock buybacks seem to be the obvious place for it to go.