Unfortunately for investors, the shocks from the coronavirus are following the horror script of a vicious unwind of financial asset prices. Despite the unprecedented stimulus from global Central BanksCSFL and governments, the situation is being perceived by most investors as getting worse, not better. What happens next? What can we do, if anything?

In my view, and as discussed in “Helicopter Money Is Here” last week in this forum, the stops are out as far as government action is concerned. As I write this piece on Sunday afternoon, expectations are building that even the fiscally conservative Germans are willing and ready to issue hundreds of billions of new money to facilitate further “direct” aid to ailing companies and consumers (In “Who In The World Is Buying These Negatively Yielding Bonds?”, I wrote that German yields are negative due to excess demand from all sorts of investors, so if they can pull this massive issuance off, they will be borrowing money and getting paid for it). I have been expecting a handoff from monetary to fiscal authorities for a few years now. But I did not expect that the handoff will happen under such unfortunate circumstances, and once the Central Banks are almost completely out of conventional ammunition, then massive fiscal stimulus becomes the only new game in town.

What is most likely to follow next is the use of new expanded monetary and fiscal tools that will be invented daily. We already saw an inkling of this as the FedFDX bought a large number of short-term municipal bonds last week. I expect we will soon see some sort of approval to print money to buy corporate bonds; ETFs and equities are probably not too far behind if the financial markets seize up. Buying corporate bonds by the Central Bank is surely going to result in a messy political debate, because lending money to corporates who have been binging on debt to spend the money, amongst other things, on massive buybacks, is going to bring out severe criticism of big company bailouts. But unless corporate spreads are somehow stabilized, a large number of companies are not going to be able to finance their operations and could potentially lay off large numbers of employees, cut salaries and benefits, and curtail spending. The taxpayer is going to be asked, yet again, to bail out large firms in order to benefit society indirectly.

While the Central Banks are cutting rates and buying bonds, pumping money into the system, the fiscal authorities will be issuing more debt. If everyone issues debt all at the same time, and the only large buyer of this huge tsunami of debt is the Central Bank, yields and spreads may be contained in the short run; however the extra cash in the system will likely result in more money chasing fewer “real” goods. In other words, we could potentially end up in a situation very rapidly where there are lots of dollars, Euros, Yen etc. but not enough goods due to the severe impact on global supply of goods.

Investors have become used to subdued inflation for decades; however just as quickly as the bull market in equities was caught in an avalanche of risk aversion, we are possibly looking at a regime change in inflation expectations as well. If this occurs, financial assets could suffer a double whammy – not only do earnings get adversely impacted due to a demand slowdown, but inflation and a rise in real rates causes investors to have a loss of confidence that the long-term inflation anchor will be maintained. If long term rates rise from incredibly low levels, the discount factor on future earnings rises, likely reducing asset prices further. To put this inflation genie back in the bottle would require tighter financial conditions, i.e. rising interest rates; however the possibility of Central Banks raising rates is very low at this time.

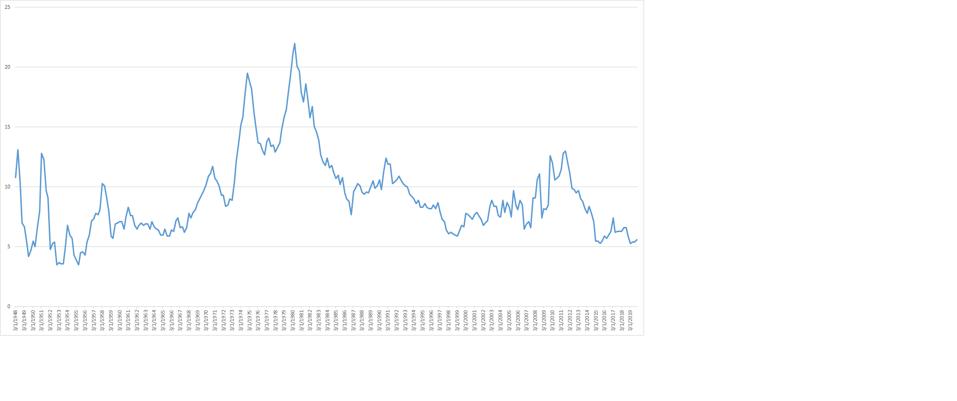

In such an environment, there are few places to hide. The so called “Misery Index” shown below could explode, causing even more increased risk-aversion and asset liquidation. The simplest version of the misery index is the sum of the unemployment rate and the inflation rate. At an unemployment rate of roughly 3% today and an inflation rate of 2%, this index is close to 5.8%, which is close to the lowest in recorded history. The misery indexes for other large regions are also toying with their all time lows (Euro Area: 8.6, Japan: 2.8, UK: 5.7 etc. Source: Bloomberg, Author). In other words, times have been just great for the last few decades in the whole world, which is why we entered this decade with optimism and record market highs.

US Misery Index from 1948-2020: US Inflation Rate + Unemployment Rate

AUTHOR

Rising misery has social ills, such as rising crime rates, so the social costs of a correlated rise in inflation and unemployment are bad not just for assets, but for quality of life.

So, what is an investor supposed to do in this environment?

There is enormous value from being liquid and having the resources to buffet increased bouts of risk aversion. Thus, first and foremost, investors should have ample liquidity in their portfolios not only to be able take advantage of opportunities as they arise, but also to draw upon the liquidity for daily needs, sustenance, and operations. Second, the opportunities that will arise in a world that is collectively inflating will arise from safe, real assets that are being sold at cheap prices. For instance, assets in the energy sector, in many cases, have lost more than half their value over the last month. Third, investors should consider looking for assets that the fiscal and monetary authorities are buying that are also safe and provide exposure to the real economy. “TIPS” or Treasury Inflation Protected Securities is one example.

Putting these three ideas together in summary means implicitly preparing for inflation to rise, while maintaining enough liquidity. And yes, one should not invest their hard earned liquidity in negatively yielding bonds, which are even more likely than ever to lose money in this market environment. I believe there is still time for investors to exit international bond funds that own these negatively yielding assets.

No one expected financial markets and the economy to turn as quickly as they did in the last few weeks. No one expects inflation to rise quickly either. While I certainly hope that inflation does not come back with a vengeance, if it does defy expectations, many investors could be blindsided, so the time to prepare is now.